Contents:

The past performance of a security, or financial product does not guarantee future results or returns. Keep in mind that while diversification may help spread risk, it does not assure a profit or protect against loss in a down market. There is always the potential of losing money when you invest in securities or other financial products. Investors should consider their investment objectives and risks carefully before investing. JSI uses funds from your Treasury Account to purchase T-bills in increments of $100 “par value” (the T-bill’s value at maturity). The value of T-bills fluctuate and investors may receive more or less than their original investments if sold prior to maturity.

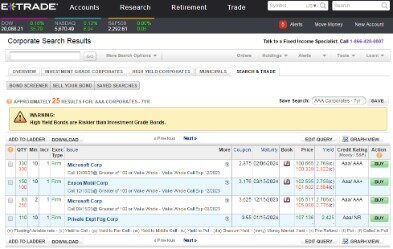

Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study. For example, a price above its moving average is generally considered an upward trend or a buy. 5 Best Commission-Free ETFs at Fidelity in 2018 Jordan Wathen | Jan 6, 2018 These five commission-free ETFs offered by Fidelity can serve as the building blocks for a diversified investment portfolio.What Is the S&P SmallCap 600? Dan Caplinger | Jul 11, 2017 Find out if you should be paying attention to this stock market index.Do You Avoid Small Caps?

The index measures the performance of the small-capitalization sector of the U.S. equity market, as determined by SPDJI. Brokerage services for alternative assets available on Public are offered by Dalmore Group, LLC (“Dalmore”), member of FINRA & SIPC. “Alternative assets,” as the term is used at Public, are equity securities that have been issued pursuant to Regulation A of the Securities Act of (“Regulation A”). These investments are speculative, involve substantial risks , and are not FDIC or SIPC insured. Alternative Assets purchased on the Public platform are not held in an Open to the Public Investing brokerage account and are self-custodied by the purchaser.

To view information on how the ETF Database Realtime Ratings work, click here. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. You should do your own research before making an investment decision.

iShares Core S&P Small-Cap ETF News

Real-time analyst ratings, insider transactions, earnings data, and more. Sign up for a Robinhood brokerage account to buy or sell IJR stock and options commission-free. Information is provided ‘as is’ and solely for informational purposes, not for trading purposes or advice, and is delayed.

7 Best Small-Cap Funds to Buy and Hold – U.S News & World Report Money

7 Best Small-Cap Funds to Buy and Hold.

Posted: Tue, 23 Apr 2019 07:00:00 GMT [source]

Small-cap ETFs have started the year hot relative to other investment factors, whether thanks to their valuations or their ability to be nimble. The actively managed class of ETFs https://day-trading.info/ was also the focus of a conversation betwe… Bloomberg The Open Jonathan Ferro drives you through the market moving events from around the world on Bloomberg’s The Open.

ETFs Find a Role in a Long-Term Portfolio

Options trading entails significant risk and is not appropriate for all investors. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. You need to complete an options trading application and get approval on eligible accounts.

The issuers of these securities may be an affiliate of Public, and Public may earn fees when you purchase or sell Alternative Assets. For more information on risks and conflicts of interest, see these disclosures. The investment seeks to track the investment results of the S&P SmallCap 600 Index composed of small-capitalization U.S. equities. Investment Strategy The investment seeks to track the investment results of the S&P SmallCap 600 Index composed of small-capitalization U.S. equities. All investments involve risks, including the loss of principal. Performance data represents past performance and is no guarantee of future results.

Diversified Healthcare Trust: A Good Gamble At Current Price Point … – Seeking Alpha

Diversified Healthcare Trust: A Good Gamble At Current Price Point ….

Posted: Fri, 21 Oct 2022 07:00:00 GMT [source]

Similar to SIPC protection, this additional insurance does not protect against a loss in the market value of securities. See IJR ETF price and Buy/Sell iShares Core S&P Small Cap ETF. Discuss news and analysts’ price predictions with the investor community. Morningstar has awarded this fund 4 stars based on its risk-adjusted performance compared to the 585 funds within its Morningstar Small Blend Category. A shortcut to view the full list of positions in your portfolio? The stock market volatility has spilled over into Large-cap ETFs.

Investment returns and principal value will fluctuate and are subject to market volatility. Current performance may be lower or higher than the performance data quoted. Click on the “Performance & Risk” link to view quarter-end performance.

Historical Prices

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities.

Here is a look at ETFs that currently offer attractive short selling opportunities. Securities trading is offered to self-directed customers by Webull Financial LLC, a broker dealer registered with the Securities and Exchange Commission . Webull Financial LLC is a member of the Financial Industry Regulatory Authority , Securities Investor Protection Corporation , The New York Stock Exchange , NASDAQ and Cboe EDGX Exchange, Inc . In this week’s ETF Wrap, BlackRock’s Gargi Chaudhuri, head of iShares investment strategy for the Americas, discusses ways for investors to play a world of higher rates and elevated inflation i… January Effect is a seasonal increase in stock prices due largely to year-end tax considerations. Investors redeploy their capital to speculate on weaker performers in January after selling winners in…

iShares Core S&P Small-Cap ETF’s Holdings Heat Map

T-bills are subject to price change and availability – yield is subject to change. Investments in T-bills involve a variety of risks, including credit risk, interest rate risk, and liquidity risk. As a general rule, the price of a T-bills moves inversely to changes in interest rates. See Jiko U.S. Treasuries Risk Disclosures for further details.

Apex Crypto is not a registered broker-dealer or FINRA member and your cryptocurrency holdings are not FDIC or SIPC insured. Please ensure that you fully understand the risks involved before trading. Not all coins provided by Apex Crypto LLC are available to New York residents. Please visit /cryptocurrency to see a list of crypto available to trade.

Top basket holdings are as of the date indicated and may not be representative of the funds current or future investments. Short Interest The total number of shares of a security that have been sold short and not yet repurchased. Change from Last Percentage change in short interest from the previous report to the most recent report. Percent of Float Total short positions relative to the number of shares available to trade. The S&P SmallCap 600 Index measures the performance of the small capitalization sector of the U.S. equity market. Zacks proprietary quantitative models divide each set of ETFs following a similar investment strategy (style box/industry/asset class) into three risk categories- High, Medium, and Low.

IShares Core S&P Small-Cap ETF, formerly iShares S&P SmallCap 600 Index Fund, seeks investment results that correspond generally to the price and yield performance of the Standard & Poor’s SmallCap 600 Index . The Index measures the performance of publicly traded securities in the small-capitalization sector of the United States equity market. The Index serves as the underlying index for the S&P 600/Citigroup Growth and Value Index series. The component stocks are weighted according to the total float-adjusted market value of their outstanding shares. The component stocks in the Index have a market capitalization between $300 million and $1 billion , and are selected for liquidity and industry group representation. The Index is adjusted to reflect changes in capitalization resulting from mergers, acquisition, stock rights, substitutions and other capital events.

- Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

- Investment return and principal value of an investment will fluctuate; therefore, you may have a gain or loss when you sell your shares.

- When you enable T-Bill investing on the Public platform, you open a separate brokerage account with JSI (the “Treasury Account“).

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.52% per year. These returns cover a period from January 1, 1988 through February 6, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month.

JSI and Jiko Bank are not affiliated with Public Holdings, Inc. (“Public”) or any of its subsidiaries. None of these entities provide tickmill review and rating, https legal, tax, or accounting advice. You should consult your legal, tax, or financial advisors before making any financial decisions.

The iShares Core S&P Small-Cap ETF Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of U.S. small-cap stocks. IShares Core S&P Small-Cap ETF is a equity fund issued by iShares. IJR focuses on small cap investments and follows the S&P SmallCap 600 Index. The fund’s investments total to approximately $66.81 billion assets under management. Before investing in any exchange traded product, you should consider its investment objective, risks, charges and expenses.